5 Simple Statements About Social Security copyright Explained

5 Simple Statements About Social Security copyright Explained

Blog Article

Get quick usage of users-only merchandise and countless discount rates, a no cost second membership, and also a subscription to AARP the Journal.

In 2009, the Office from the Main Actuary of the SSA calculated an unfunded obligation of $15.one trillion for your Social Security method. The unfunded obligation may be the difference between the long run expense of the Social Security system (according to numerous demographic assumptions for example mortality, workforce participation, immigration, and age expectancy) and complete belongings in the Believe in Fund provided the expected contribution amount via the current scheduled payroll tax.

You're not permitted to use durations, commas, or other Specific characters for some responses, together with addresses. If you will get a information concerning this, return and enter the information without intervals or other figures.

Threaten you with arrest or lawful action since you don’t agree to pay revenue immediately. Suspend your Social Security selection.

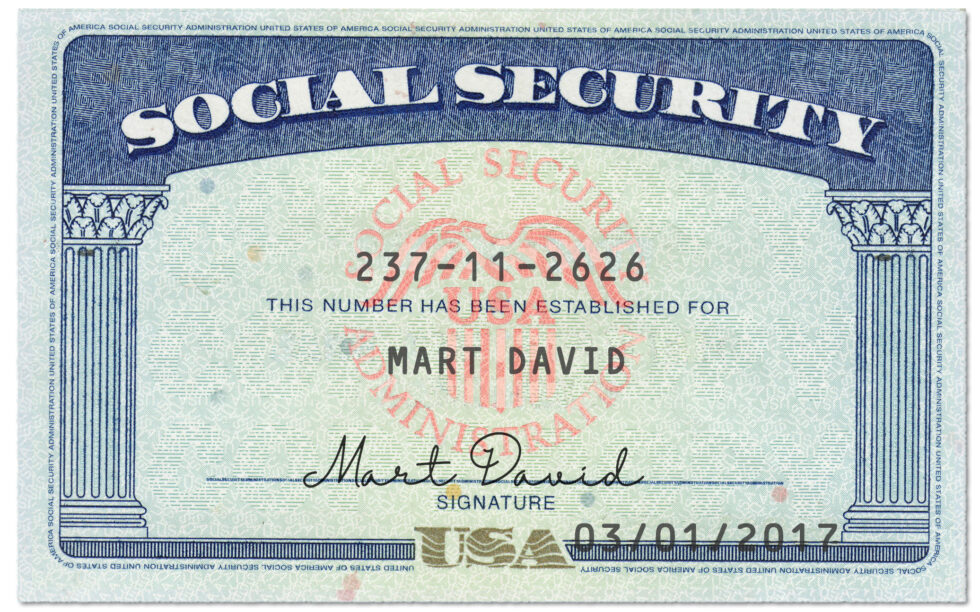

Because of the importance of Social Security to millions of american citizens, a lot of immediate-mail Entrepreneurs packaged their mailings to resemble Formal communications within the SSA, hoping recipients could be a lot more likely to open them. In reaction, Congress amended the Social Security Act in 1988 to ban the private use from the phrase "Social Security" and a number of other relevant terms in almost any way that may convey a Bogus impression of acceptance in the SSA.

You can do the majority of your small business with Social Security on-line. If You can't use these on line products and services, your area Social Security Office environment may help you apply. Though our places of work are closed to the general public, workforce from Individuals workplaces are aiding people today by telephone.

Our staff won't ever threaten you for information and facts or assure a profit in exchange for personal information or money.

If the individual was born less than one hundred twenty a long time ago, Additionally you need to have to include evidence of Loss of life with your ask for.

There might be an early increase in Social Security earnings that could be partly offset later by the advantages they could collect if they retire.[citation necessary]

You could choose to extend your time over the web site if you have this warning. On the other hand, following the third warning, you will need to transfer to a different web site or your facts will not be saved.

Criminals go on to impersonate SSA along with other authorities organizations within an make an effort to receive own info or dollars.

[seventy two] As While using the retirement benefit, the quantity of the disability reward payable will depend on the worker's age and history of coated earnings.

At present, a retiree's advantage is every year adjusted for inflation to replicate alterations in The patron price index.[214] Some economists check here argue that the consumer selling price index overestimates selling price improves in the economic climate and for that reason just isn't a suitable metric for modifying Advantages, while some argue that the CPI underestimates the impact of inflation on what retired people truly really need to purchase to live.

Originally the advantages been given by retirees were not taxed as revenue. Beginning in tax calendar year 1984, Along with the Reagan-era reforms to fix the procedure's projected insolvency, retirees with incomes over $25,000 (in the situation of married persons submitting independently who didn't Dwell Using the spouse at any time during the yr, and for persons submitting as "solitary"), or with combined incomes over $32,000 (if married filing click here jointly) or, in sure circumstances, any revenue total (if married filing separately through the partner within a calendar year wherein the taxpayer lived Along with the wife or husband at any time) normally noticed Element of the retiree Gains matter to federal revenue tax.